Dedicated Tax Counsel

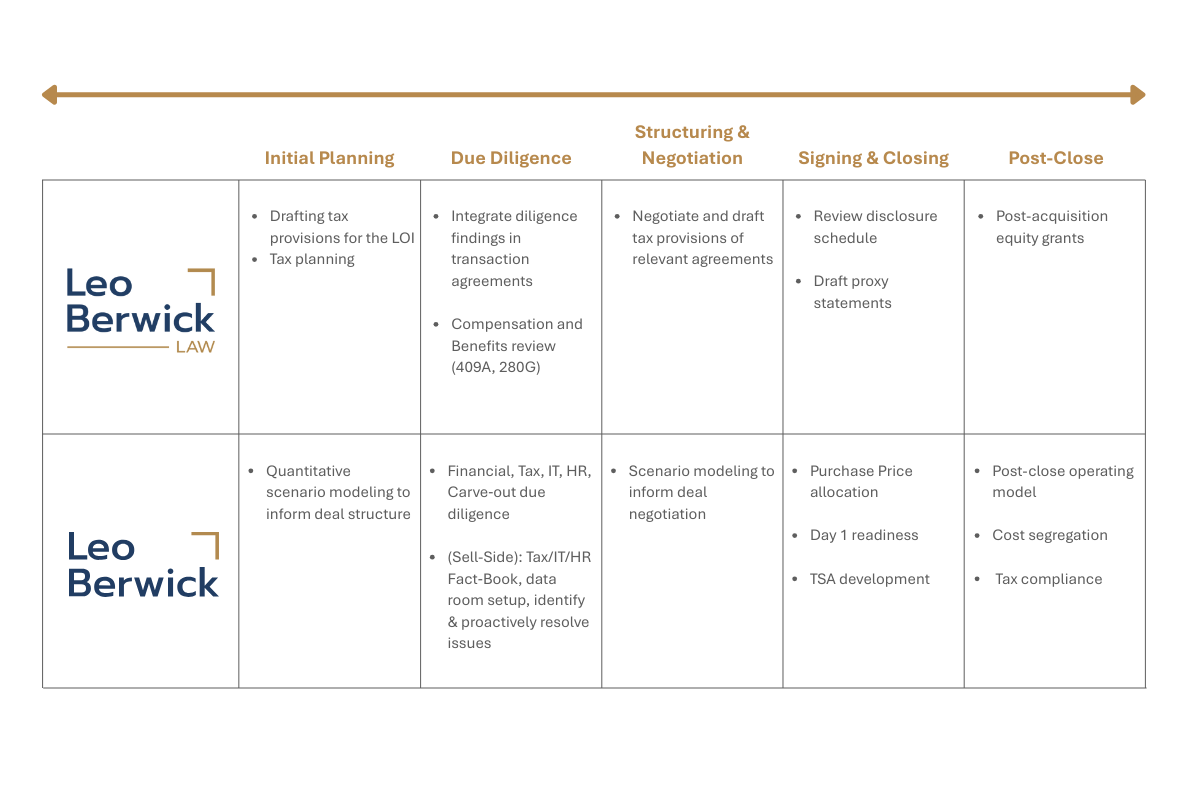

Comprehensive Offerings Across Deal Lifecycle

From tax structuring and diligence through post-close implementation, a single engagement letter unlocks end-to-end tax and advisory services, including services not offered by traditional law firms.

Tax Service Offerings

M&A Tax Advisory

We draft and negotiate tax provisions in M&A and joint venture agreements, structure tax efficient asset and stock transactions, perform tax due diligence, and identify tax saving opportunities such as credits, depreciation, and amortization.

Compensation & Benefits

We support executive compensation planning, including drafting compensation arrangements, advising Sections 280G and 409A, and preparing 83(b) elections to ensure compliance and effective tax planning.

General Tax Advisory

We implement accounting methods and elections, prepare and document tax positions to mitigate deal risk, and provide technical compliance support for M&A and restructuring transactions.

International & Cross-Border Tax Advisory

We advise clients on a full range of international tax issues, including withholding taxes, transfer pricing, and tax treaty application, and structure cross border transactions to navigate multi-jurisdictional tax requirements efficiently.

Tax Insurance Underwriting

We assist insurers in evaluating tax risks for coverage, including contingent liabilities, permanent establishment exposure, loss carrybacks, sham transaction concerns, and tax treatment of rescissions, reformations, and tax deferred property contributions.

We’re here to help.

Whether you’re exploring a new transaction, navigating a complex tax issue, or simply want to learn more about our services, our team is ready to connect.